|

Sri Priya PonnapalliR&D Engineer, Portfolio & Risk Analytics, Bloomberg LP 2010 Ph.D. in Electrical and Computer Engineering, University of Texas at Austin Dissertation Title: Higher-order generalized singular value decomposition – a comparative mathematical framework with applications to genomic signal processing Advisor: Orly Alter |

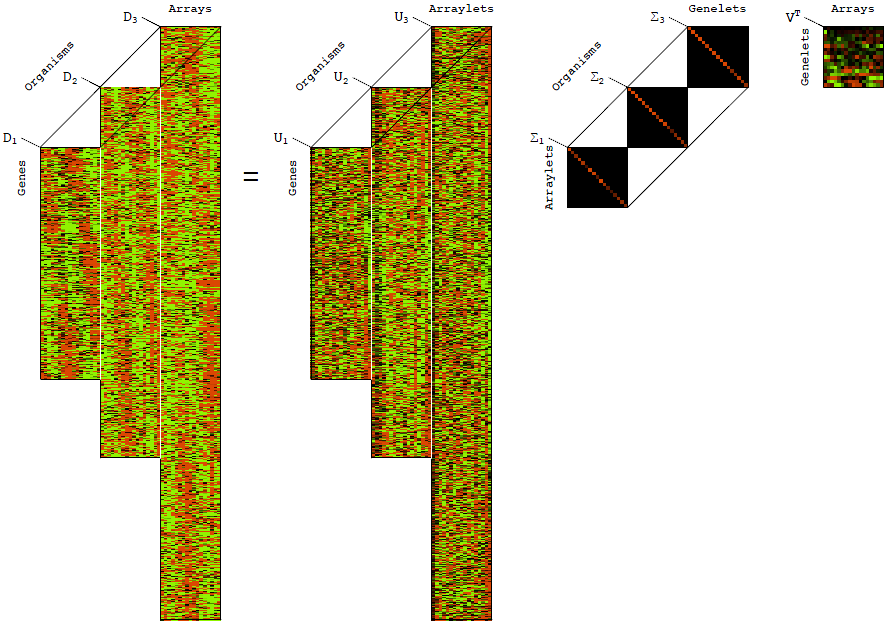

Dr. Sri Priya Ponnapalli received her Ph.D. in Electrical and Computer Engineering in 2010 from the University of Texas at Austin, working in the Genomic Signal Processing Lab of Dr. Orly Alter, USTAR Associate Professor of Bioengineering and Human Genetics at the SCI Institute. In her Ph.D. dissertation, Dr. Ponnapalli developed a novel mathematical framework for the comparison of multiple large-scale datasets that are arranged in tables of different row dimensions but the same column dimensions. The number of such datasets, recording different aspects of a single phenomenon, is fast growing in science and medicine. Gaining access to the full information that these datasets store requires mathematical frameworks that can compare and contrast them in order to find the similarities and dissimilarities among them. Until now only one such framework existed, which was limited to a comparison of two datasets at a time.

Ponnapalli and Alter, in collaboration with Drs. Charles F. Van Loan of Cornell University and Michael A. Saunders of Stanford University, formulated a novel generalization of the existing framework that enables comparison of more than just two datasets at a time. The team demonstrated the novel framework in comparative modeling of the cellular activities of three evolutionarily disparate organisms – human and budding and fission yeasts. The mathematical model successfully identified and separated cellular events that are common to the human and yeasts from those that are exclusive to only one of the organisms. (To read the 2011 PLoS One article, visit http://dx.doi.org/10.1371/journal.pone.0028072 ).

Alter's previous comparative modeling of the cellular activities of just two of the organisms – human and budding yeast – led to the computational prediction of a new mode of biological regulation, which she then experimentally verified in collaboration with Dr. John F. X. Diffley of Cancer Research UK. The Genomic Signal Processing Lab's recent comparative modeling of the genomes of just two cell types – normal and brain cancer cells – uncovered a new link between a brain tumor's genome and a patient's prognosis, which offers insights into the cancer's formation and growth, and suggests promising targets for drug therapy. Just as these discoveries were made possible by the ability to compare between two datasets, the mathematical framework formulated by Ponnapalli in her Ph.D. dissertation, which enables – for the first time – a comparison of more than two datasets at a time, promises to lead to discoveries that would have been impossible without it. Although this mathematical framework was developed with applications in biotechnology in mind, it could similarly be used to make discoveries in any of the many areas where large-scale datasets are being accumulated today.

Since graduating in 2010, Dr. Ponnapalli has been applying her mathematical expertise to large-scale financial datasets in her role as an R&D Engineer for Bloomberg LP's Portfolio & Risk Analytics team in New York City.

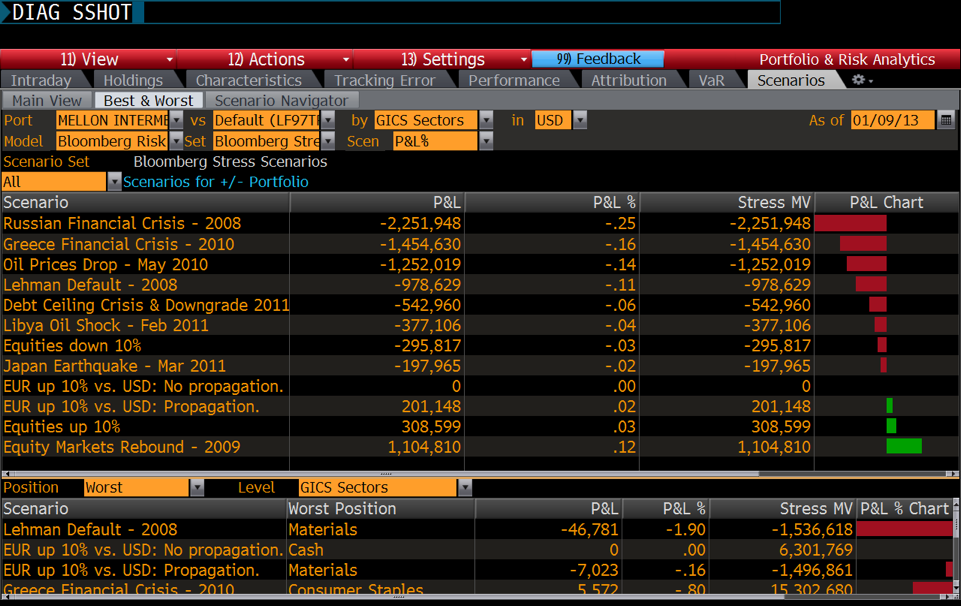

Ponnapalli's team develops and maintains a comprehensive portfolio risk management tool. Bloomberg's clients use this tool to analyze, evaluate and reduce potential risks that may be associated with their investment portfolios. A recent add-on to the tool – the Scenario Analysis Function – allows customers to create custom scenarios representative of world-events such as the "Debt Ceiling Crisis" or the "Libyan Oil Shock" and predict the impact of these scenarios on the value of their portfolio. (To read more, visit http://www.bloomberg.com/professional/tools-analytics/portfolio-risk-analytics/ ).

Underlying the scenario analysis function are multi-factor models, built by Ponnapalli and her team. In a factor model, the return on each security is a linear combination of a small number of common factors and asset-specific, or idiosyncratic returns. At present, factor models are built specific to each asset class such as fixed-income or equities. In the future, it may be possible to apply Ponnapalli's comparative framework to multi-asset datasets and discover a common set of factors to build a multi-asset factor model.